Gaming Console Market Size Projected to Reach USD 98.15 Billion by 2032

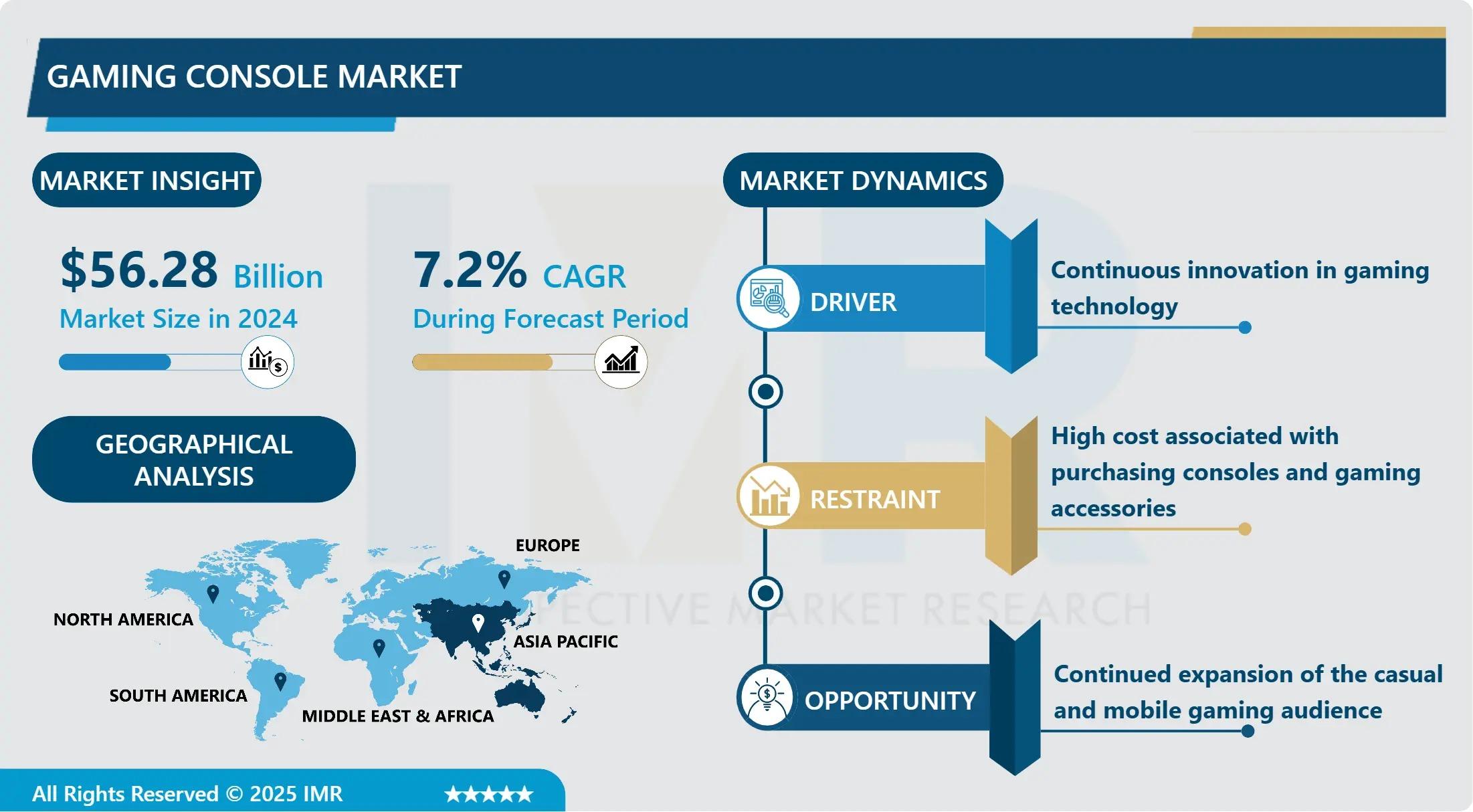

According to a new report published by Introspective Market Research, Gaming Console Market by Type, End-User, and Distribution Channel, The Global Gaming Console Market Size Was Valued at USD 56.28 Billion in 2024 and is Projected to Reach USD 98.15 Billion by 2032, Growing at a CAGR of 7.2%.

Market Overview

The global gaming console market continues to demonstrate robust growth, underpinned by technological innovation and the expanding cultural footprint of video games as mainstream entertainment. Gaming consoles are dedicated electronic devices designed primarily for playing video games, offering a curated, high-performance experience. Their key advantages over traditional PC gaming include optimized hardware-software integration for seamless performance, exclusive game titles, and a user-friendly plug-and-play ecosystem that appeals to a broad audience. Modern consoles have evolved into comprehensive entertainment hubs, integrating streaming services, social features, and digital storefronts.

Growth Driver

The most significant growth driver for the gaming console market is the rapid expansion and monetization of digital distribution and subscription-based services. The shift from physical discs to digital downloads and the rise of all-you-can-play subscription models have created a recurring revenue stream that complements cyclical hardware sales. Services like Xbox Game Pass Ultimate and PlayStation Plus Extra/Premium offer vast libraries of games for a monthly fee, lowering the barrier to entry for trying new titles and fostering continuous engagement. This "Netflix for games" model not only drives consistent revenue but also strengthens platform loyalty, as subscribers are more likely to remain within a console's ecosystem for their gaming needs.

Market Opportunity

A substantial market opportunity lies in the strategic development and integration of cloud gaming and hybrid hardware-service models. While traditional console cycles will continue, the future points toward services that allow players to stream high-end games to less powerful devices, including older consoles, PCs, and mobile phones. The opportunity exists for console manufacturers to offer tiered subscription plans that combine access to a physical console, a cloud streaming library, and exclusive perks. Furthermore, there is significant potential in expanding into emerging markets with more affordable, streaming-focused console SKUs or dedicated streaming sticks, which can tap into vast new consumer bases in regions like Southeast Asia and Latin America where high upfront hardware costs are a barrier.

The Gaming Console Market is segmented on the basis of Type, End-User, and Distribution Channel.

Type

The Type segment is further classified into Home Consoles and Handheld Consoles. Among these, the Home Console sub-segment accounted for the dominant market share. Home consoles, such as the PlayStation, Xbox, and Nintendo Switch (in its docked mode), are the powerhouses of the industry, delivering the highest graphical fidelity, most expansive game libraries, and deepest integration with home entertainment systems. Their performance capabilities make them the preferred platform for major AAA game releases and competitive esports, driving significant hardware sales at the start of each generation and continuous software and accessory revenue throughout their lifecycle.

Distribution Channel

The Distribution Channel segment is further classified into Online and Offline. Among these, the Online channel has become the leading and fastest-growing segment. Sales through console makers' own digital storefronts (PlayStation Store, Xbox Marketplace, Nintendo eShop) and major online retailers like Amazon dominate. The convenience of instant game downloads, frequent digital sales, the direct-to-consumer model for subscriptions, and the widespread adoption of digital gift cards have fueled this shift. The COVID-19 pandemic accelerated this trend, cementing online as the primary channel for both console and game purchases.

Some of The Leading/Active Market Players Are-

· Sony Interactive Entertainment (Japan)

· Microsoft Corporation (USA)

· Nintendo Co., Ltd. (Japan)

· Valve Corporation (USA)

· NVIDIA Corporation (USA)

· Atari SA (France)

· Sega Sammy Holdings Inc. (Japan)

· NEC Corporation (Japan)

· Bandai Namco Entertainment Inc. (Japan)

· Mad Catz Global Limited (USA)

· Hyperkin, Inc. (USA)

· PDP (Performance Designed Products) (USA)

· “and other active players.”

Key Industry Developments

News 1:

In February 2024, Microsoft announced strategic shifts in its Xbox business, planning to bring several formerly exclusive titles to rival platforms like PlayStation and Nintendo Switch.

This move signals a potential industry trend towards greater multiplatform publishing, focusing on software and service revenue over strict hardware exclusivity to maximize game reach and profitability.

News 2:

In September 2023, Sony Interactive Entertainment launched a new, slimmer model of the PlayStation 5 console, offering a redesigned form factor and increased internal storage.

This hardware revision aims to reduce manufacturing costs, attract new buyers with a more compact design, and cater to existing users seeking additional storage, effectively extending the mid-lifecycle appeal of the PS5 platform.

Key Findings of the Study

· Home Consoles dominate the type segment, and the Online channel leads distribution.

· North America is the largest revenue-generating region, while Asia-Pacific is the fastest-growing market.

· Growth is primarily driven by the adoption of digital subscription services and the strength of exclusive game titles.

· Key trends include the industry's pivot towards service-based revenue models and the ongoing integration of cloud gaming features.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness