-

NEUIGKEITEN

- EXPLORE

-

Seiten

-

Gruppen

-

Blogs

-

Foren

Light Aircraft Market: Expanding Regional and Private Aviation

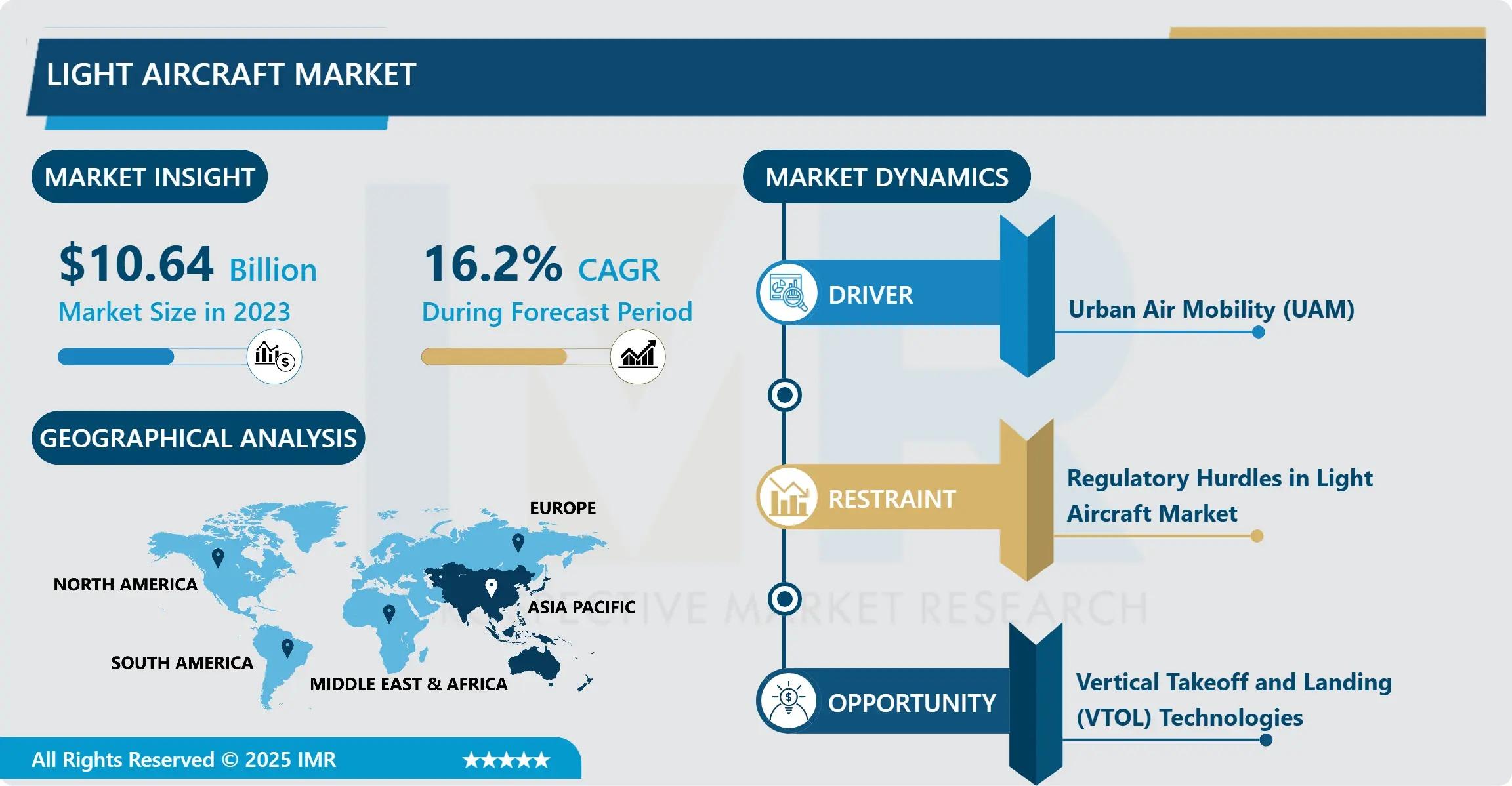

According to a new report published by Introspective Market Research, the Global Light Aircraft Market by Aircraft Type, Technology, and Application, valued at USD 10.64 Billion in 2023, is projected to reach USD 41.1 Billion by 2032, growing at an impressive CAGR of 16.2% from 2024 to 2032. This explosive growth is primarily fueled by burgeoning demand in aviation training, the proliferation of urban air mobility concepts, the rise of recreational flying, and the critical need for efficient on-demand transportation in remote and regional areas.

The Light Aircraft Market encompasses small, fixed-wing and rotary-wing aircraft typically with a maximum takeoff weight (MTOW) of 12,500 lbs or less, including single-engine piston planes, light jets, very light jets (VLJs), and helicopters. These aircraft offer significant operational and economic advantages over larger commercial airliners and older models, including lower acquisition and operating costs, shorter runway requirements, greater fuel efficiency, and versatility for point-to-point travel. They serve as essential tools for pilot training, private/business transportation, emergency medical services, agricultural work, and aerial surveying, filling a vital niche in the global aviation ecosystem.

A Key Growth Driver: The Global Pilot Shortage and Flight Training Expansion

A primary force propelling the light aircraft market is the severe and persistent global shortage of commercial pilots, which is driving massive investment in flight training infrastructure worldwide. Airlines, flight schools, and aviation academies are expanding their fleets of training aircraft to meet the demand for thousands of new pilots required over the next decade. Light, single-engine piston aircraft are the fundamental platform for ab-initio (from zero) pilot training. This creates a sustained, high-volume market for new and used trainer aircraft, simulators, and related services. Additionally, the modernization of training fleets with newer, technologically advanced aircraft featuring glass cockpits similar to airliners is accelerating the replacement cycle of older models.

A Key Market Opportunity: The Dawn of Advanced Air Mobility and Electric Aviation

A monumental market opportunity lies in the emerging Advanced Air Mobility (AAM) sector and the transition to electric propulsion. This encompasses the development of electric vertical take-off and landing (eVTOL) aircraft for urban air taxi services and hybrid-electric fixed-wing aircraft for regional commuting. This segment represents a potential paradigm shift, creating entirely new markets for short-haul, on-demand air travel while addressing sustainability concerns. Companies that successfully certify, manufacture, and deploy these innovative aircraft will capture first-mover advantage in a multi-billion-dollar frontier, disrupting traditional transportation models and catering to a growing demand for faster, cleaner, and more accessible point-to-point mobility solutions.

The Light Aircraft Market is segmented on the basis of Aircraft Type, Technology, and Application.

Application

The Application segment is further classified into Flight Training, Personal & Recreational, Business Transportation, Aerial Work, and Others. Among these, the Flight Training sub-segment accounted for the highest market share in 2023. This segment is the bedrock of the light aircraft industry, consuming the largest number of units annually. The relentless demand for new pilots to support global airline growth ensures a continuous and predictable market for trainer aircraft. Flight schools prioritize reliable, cost-effective, and modern aircraft with digital cockpits to best prepare students for airline careers, making this the most stable and volume-driven application segment.

Technology

The Technology segment is further classified into Conventional Aircraft and Electric & Hybrid-Electric Aircraft. Among these, the Conventional Aircraft sub-segment accounted for the highest market share in 2023, driven by decades of established technology, infrastructure, and regulatory frameworks. However, the Electric & Hybrid-Electric Aircraft sub-segment is projected to exhibit the highest CAGR during the forecast period. This explosive growth is driven by intense R&D investment, environmental regulations, and the potential for significantly lower operating costs and noise, making it the most dynamic and high-potential area of the market, poised to reshape the industry's future.

Some of The Leading/Active Market Players Are:

· Textron Aviation Inc. (USA) - Cessna, Beechcraft

· Cirrus Aircraft (USA)

· Piper Aircraft, Inc. (USA)

· Diamond Aircraft Industries (Austria/Canada)

· Pilatus Aircraft Ltd. (Switzerland)

· Airbus SE (Netherlands/France) - Airbus Helicopters, AAM division

· Honda Aircraft Company (USA/Japan)

· Embraer S.A. (Brazil) - Phenom jets

· Joby Aviation (USA)

· Archer Aviation Inc. (USA)

· Lilium N.V. (Germany)

· Vertical Aerospace Group Ltd. (UK)

· Robinson Helicopter Company (USA)

· Boeing (USA) - through investments & Aurora Flight Sciences

· Mooney International Corporation (USA)

and other active players.

Key Industry Developments

News 1: Major Certification Milestone for eVTOL Aircraft

In December 2024, Joby Aviation received a crucial type certification validation from a major aviation authority for its five-seat eVTOL air taxi, marking a significant step toward commercial service launch. The achievement underscores progress in bringing electric air mobility to reality.

This development is pivotal for the entire AAM industry, demonstrating that regulatory pathways for these novel aircraft are materializing and building confidence among investors, partners, and future customers in the feasibility of urban air taxi services.

News 2: Strategic Partnership for Pilot Training Fleets

In August 2024, a leading European flight training group announced a landmark order for over 100 new-generation single-engine training aircraft from a major manufacturer, coupled with a comprehensive long-term service agreement. The deal aims to standardize and modernize its global training fleet.

This partnership highlights the fleet modernization trend within the training segment, where large-scale, long-term agreements are becoming common as training organizations seek to secure aircraft supply, control costs, and ensure training quality with the latest technology.

Key Findings of the Study

· The Flight Training application and Fixed-Wing aircraft type segments dominate current market revenue.

· North America is the largest regional market, while the Asia-Pacific region is expected to register the highest CAGR, driven by aviation growth in China and India.

· Key growth is fueled by the global pilot shortage, rising demand for private aviation, and the emergence of Advanced Air Mobility (AAM).

· The most transformative trend is the rapid development and anticipated commercialization of electric and hybrid-electric aircraft.

· The competitive landscape is evolving with entrenched general aviation manufacturers competing with well-funded eVTOL and electric aircraft startups.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness