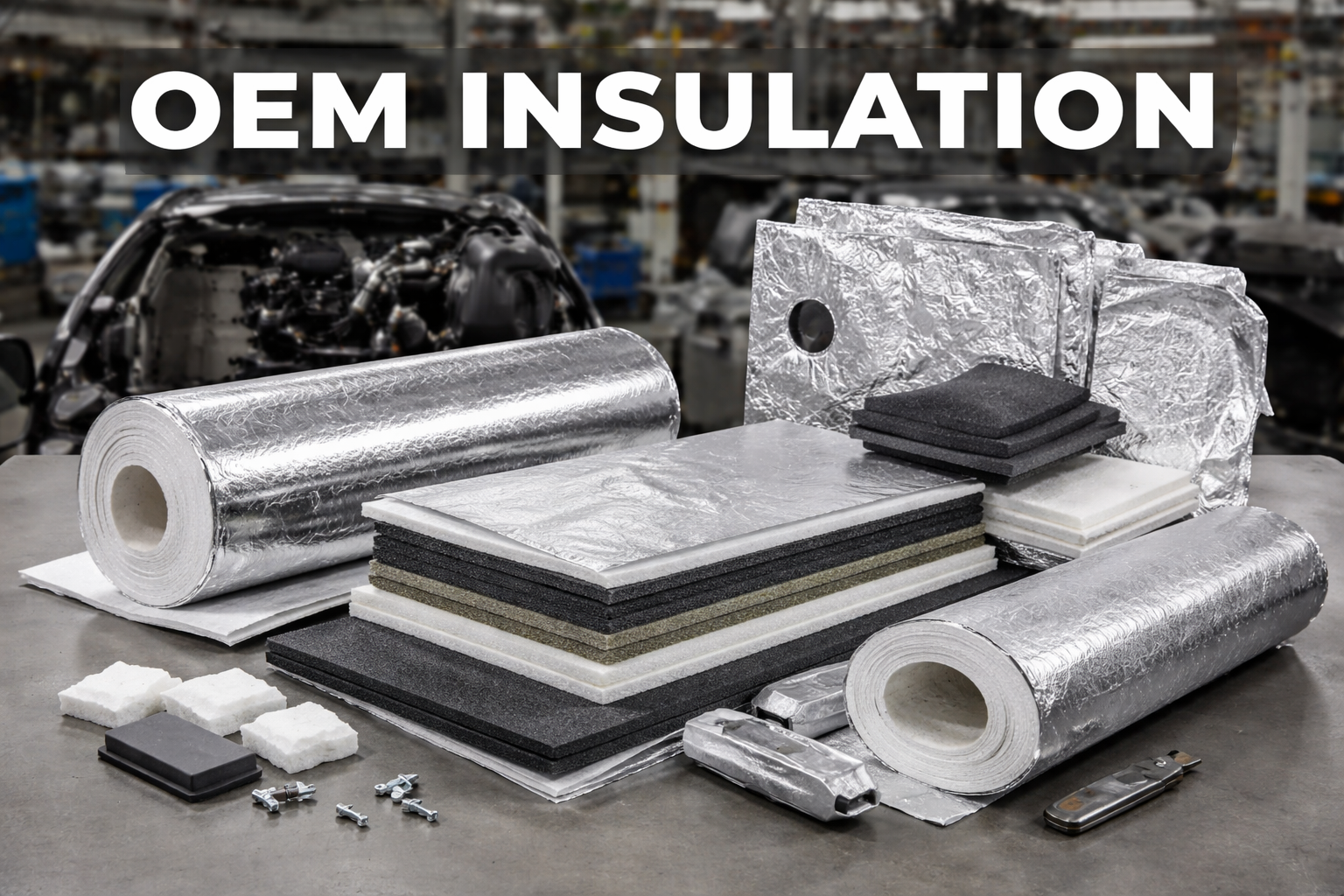

OEM Insulation Market Global Share, Size, Segmentation, and Growth Forecast to 2030 | At CAGR of 5.5%

OEM Insulation Market is projected to grow from USD 17.99 billion in 2024 to USD 24.80 billion by 2030, at a CAGR of 5.5%. The research report covers market size, competitive landscape, demand with OEM Insulation market trends, and industry development, offering strategic insights for stakeholders navigating this rapidly evolving sector. Increasing power and energy requirements in emerging economies and stringent regulations mandating insulation materials for energy conservation drive the OEM insulation market. Many HVAC equipment manufacturers are focusing on bringing technical advancements of HVAC equipment used in the construction sector, driving the global OEM insulation market. Another factor driving the growth of the OEM insulation market is the large number of public transport vehicles adopting air-conditioned technology. Governments of various countries are now adopting an integrated approach to conserve energy and implementing an energy management system, which varies according to traffic and environmental conditions.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=161776724

The Polyurethane Foam (PUF) segment is estimated to hold the maximum revenue share of the OEM insulation market based on OPE values projected to grow with prompt advancement owing to its thermal insulation properties, weightlessness, and flexibility, which make it used in almost every sector—automotive, construction, appliances, and industrial equipment are amongst them—and the expected EPSret underway.

PUF offers high energy efficiency by lowering heat transfer for heat barrier applications. In the automotive segment, PUF is often used for heating, ventilation, and air conditioning system insulation, which aids in noise reduction and accommodates passenger comfort.

It's also highly adaptable for diverse forms and sizes, perfect for intricate design criteria. Due to the growing environmental regulations, PUF insulates walls, roofs, and floors due to the necessity of building energy-efficient structures in the construction industry.

Additionally, polyurethane formulations have continued to improve with, for example, the addition of low-global warming potential blowing agents, and the resulting PUF has emerged as one of the most environmentally friendly solutions, with that reason being its adoption. PUF remains exclusive in the OEM insulation market due to its unrivaled R-value, strength, ease of application as spray or injection, and overall cost-effectiveness and sustainability.

Transportation is projected to be the fastest-growing segment of the OEM Insulation market by value by end-use during the forecast period.

Overall, the value-based OEM insulation market in the transportation sector is projected to grow at the fastest CAGR during the forecast period. This is driven by high demand for energy-efficient and lightweight vehicles, stringent government emission regulations, and passenger comfort/safety awareness. Almost all automotive, aerospace, marine, and rail industries use insulation materials in high volumes since they impact end performance from a thermal management, noise reduction, and vibration control standpoint.

The automobile market, where electric vehicle (EV) production is going through exponential demand growth, is one of the significant factors driving advanced insulation solution requirements. To support this, EVs have required highly selective heat management to keep the batteries safe, charged, and functional for passenger safety. This has driven the penetration of high-performance polyurethane foam or polyisocyanurate insulation materials. Similarly, aerospace needs lightweight insulation material for fireproofing to meet performance and safety standards in stricter industries. As part of it all, the increasing preference for sustainable transportation solutions has also resulted in market growth through the helping hand of ecologically insulation materials. Moreover, rapid urbanization and public transportation infrastructure investments in emerging markets across the Asia Pacific are expected to create positive prospects for OEM Insulation manufacturers. This cocktail of regulatory and commercial pressures and technological progress is the reason for such strong growth in the transport segment.

Get a Sample Copy of This Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=161776724

By region, Europe is estimated to account for the largest segment of the OEM Insulation market in 2023.

Europe became the largest segment of the OEM insulation market in 2023, enhanced by strict regulatory requirements, a solid industrial base, and increasing emphasis on environmental factors. The European environmental initiatives and programs on climate, culminating into the EU Green Deal, played a significant part in shaping heightened demand for advanced insulation solutions in sectors such as automotive, aerospace, construction and HVAC that require these solutions. Industries are gearing up to make use of energy-efficient insulation to make sure their constructions are up to new energy performance standards and to minimize their respective carbon footprints.

The automotive sector has been the driving force behind the increase in the OEM market for insulation, particularly the increasing demand for electric vehicles (EV). Insulatory materials are foundational for enabling thermal matters effectively to increase battery efficiency and control the noise levels in EVs. Correspondingly, Europe's aerospace industry has always been in need of lightweight fireproof insulations to enhance fuel efficiency and comply with stringent safety and environmental regulations.

With Europe taking initiatives in R&D and innovation, Europe has provided the platform for developing green and high-performance densities. The OEM insulation continuum in Europe has been reinforced by key insulator suppliers and technological advancements remaining present. Europe is now expected to hold on to its dominant market position in OEM insulation as sustainability becomes an increasingly central consideration.

The major players operating in the OEM Insulation market include Covestro AG (Germany), Owens Corning Corp. (US), Rockwool International A/S (Denmark), Saint-Gobain ISOVER (France), Knauf Insulation (US), Huntsman Corporation (US), Armacell International S.A. (Luxembourg), Aspen Aerogels Inc. (US), Johns Manville Corporation (US), Kingspan Group (Ireland), China Jushi Co. Ltd. (China), and Rogers Corporation (US) are the key players in the market.

Covestro AG (Germany)

Covestro AG is a prominent producer and supplier of high-quality polymers and polyurethane foams. Covestro AG is a Bayer subsidiary established in 2015, formerly known as Bayer Material Science. With a primary focus on producing advanced polymer materials and creating cutting-edge solutions for daily usage, it is involved in various commercial endeavors.

Owens Corning (US)

Owens Corning, a global insulation manufacturing company, provides thermal and acoustic products at high, mid, and low temperatures. Insulation, Composites, and Roofing comprise the organization's three segments. It offers insulation solutions to the commercial, industrial, and residential sectors. The organization provides thermal and acoustic products for appliances, including the range/oven, dishwasher, and laundry, through the OC appliances application. It provides insulation for various markets, including commercial interiors (wall panels), HVAC equipment, and water heaters.

Inquire Before Buying: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=161776724

Rockwool A/S (Denmark)

ROCKWOOL A/S manufactures a broad range of insulation products for the insulation industry. The company’s products are based on premium and innovative stone wool technology. It generates revenue from five brands: ROCKWOOL, Rockfon, Rockpanel, Lapinus, and Grodan.

SAINT GOBAIN ISOVER (France)

Saint-Gobain is a global manufacturer and distributor of insulation materials. It provides technical insulation materials through its subsidiaries, ISOVER and Izocam (Istanbul, Turkey). The company is an insulation sub-brand of the Saint-Gobain Group and the world's leading supplier of sustainable insulation solutions for various markets in buildings, transportation, and industrial applications. It also caters to applications in process, marine, and horticultural industries. ISOVER offers technical insulation products used in boilers, ovens, and pipework under the construction products segment.

kNaUF INSULATION(US)

Knauf Insulation is a multinational company and a part of Knauf Group, which manufactures buildings & construction materials. Knauf Insulation produces insulation materials made of glass wool, stone wool, wood wool boards, polystyrene, and others. It is one of the leading manufacturers of modern insulation materials, dry lining systems, plasters and accessories, thermal insulation composite systems, paints, floor screed, floor systems, and construction equipment and tools worldwide. Significant applications of Knauf Insulation products are building, OEM, technical, and green solutions. Under OEM solutions, the company serves applications such as automotive, chimney systems, domestic appliances, doors, horticulture, machine production, prefabricated buildings, road sound barriers, and thermal solar panels.

Speak to Expert: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=161776724

Reasons to Buy this Report:

✤ Upgrade your market research resources with this comprehensive and accurate report on the global OEM Insulation Market

✤ Get a complete understanding of general market scenarios and future market situations to prepare for rising above the challenges and ensuring strong growth

✤ The report offers in-depth research and various tendencies of the global OEM Insulation Market

✤ It provides a detailed analysis of changing market trends, current and future technologies used, and various strategies adopted by leading players of the global OEM Insulation Market

✤ It offers recommendations and advice for new entrants in the global OEM Insulation Market and carefully guides established players for further market growth

✤ Apart from the hottest technological advances in the global OEM Insulation Market, it brings to light the future plans of dominant players in the industry

- OEM_Insulation_Market_Analysis

- Demand_for_Mineral_Wool

- OEM_Insulation_Market_Segmentation

- Demand_for_Fiberglass_Mat/Needled

- Glass_Wool_Industry_Trends

- Sales_of_OEM_Insulation

- OEM_Insulation_Market

- OEM_Insulation_Market_Demand

- Ceramic_&_High-Temp_Market_Analysis

- OEM_Insulation_Industry_Trends

- Demand_for_Reflective_&_Others

- Foamed_Plastic_Market_Share

- Demand_for_OEM_Insulation

- OEM_Insulation_Market_Share

- OEM_Insulation_Market_Size

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness