-

Noticias Feed

- EXPLORE

-

Páginas

-

Grupos

-

Blogs

-

Foros

Streaming Industry Profitability: 2025 Milestone

Streaming Industry Achieves Profitability

Streaming Industry Reaches Profitability Milestone in 2025, But Success Metrics Remain in Flux

The streaming landscape witnessed a significant transformation in 2025, marking the first year of industry-wide profitability after half a decade of financial losses. This watershed moment signals a maturing market, though the path forward remains complex for major players.

Despite this positive trend, profitability hasn't been universal. Peacock continues to operate at a loss for NBCUniversal, and Apple TV+'s financial performance remains obscured within its parent company's massive balance sheet. Nevertheless, 2025 represents a crucial inflection point for the industry.

Financial discipline has become the new norm as streaming services face increased scrutiny from investors. The era of unlimited content spending has ended, with even industry leader Netflix maintaining strict budget controls. Interestingly, linear television still commands approximately twice the investment dollars compared to streaming platforms, according to Morgan Stanley analysts.

Looking ahead to 2026, industry experts anticipate "streaming market repair" becoming the dominant theme. Corporate reorganizations and accelerating cord-cutting trends continue to diminish traditional television's relevance as an investment vehicle.

The competitive landscape evolved significantly in 2025, with Disney launching an enhanced ESPN app that integrates linear network feeds with streaming-exclusive content. Fox Corporation made similar strategic moves with its Fox One platform. Meanwhile, potential industry consolidation loomed large as Netflix and Paramount pursued Warner Bros. Discovery assets.

Perhaps most telling about the industry's maturation is the shift in performance metrics. Both Netflix and Disney announced plans to discontinue quarterly subscriber reporting, instead emphasizing revenue per user, engagement statistics, and other financial indicators. This evolution reflects streaming's transition from growth-at-all-costs to sustainable business models.

As streaming services navigate this new era of profitability expectations, how success is measured and interpreted continues to evolve, leaving major players searching for the right balance between growth and financial sustainability.

Streaming platforms celebrated financial milestones in 2025,

yet defining true success remains a complex puzzle.

Major services are grappling with measurement challenges,

as traditional metrics like subscriber counts prove insufficient.

The industry shift towards profitability has intensified,

prompting reevaluations of content investment versus returns.

Original programming continues to drive audience engagement,

with award-winning series becoming crucial differentiators.

Rebranding efforts across the sector have sometimes backfired,

creating confusion rather than clarifying service offerings.

Behind the scenes, executives acknowledge strategic delays,

admitting their platforms aren't advancing as rapidly as hoped.

The advertising tier dilemma presents a critical crossroads,

as some holdouts resist this revenue model while competitors embrace it.

Corporate integration complicates standalone streaming assessment,

when services are bundled within larger business divisions.

The coming year will test whether quiet consistency triumphs,

or if disruptive moves will be necessary to capture market attention.

Technological giants approach streaming with distinct philosophies,

often diverging from traditional media company playbooks.

The fundamental question persists beyond profitability:

how to quantify cultural impact and viewer loyalty effectively.

Disney's Streaming Journey: Triumphs and Turbulence in 2025

ESPN's streaming revolution marked a significant milestone in 2025, transforming from a limited offering to a comprehensive sports platform. The August launch of their enhanced service delivered unprecedented access to Monday Night Football across both ESPN and ABC channels, complemented by numerous streaming-exclusive games. This expansion followed Disney's strategic acquisition of NFL Network/RedZone, substantially strengthening their sports streaming portfolio. Additionally, WWE premium live events found a new home on ESPN's platform, further diversifying their content lineup.

However, Disney faced considerable challenges in the public arena. The controversial decision to temporarily suspend Jimmy Kimmel's program amid Trump administration pressure sparked significant backlash. This move triggered widespread cancellation campaigns targeting Disney+ and Hulu subscriptions. While the complete financial impact remains difficult to quantify, industry reports suggest millions of American subscribers terminated their services in response. The company's recent decision to discontinue reporting quarterly streaming subscriber figures further complicates efforts to assess the full economic consequences of this controversy.

Looking ahead to 2026, Disney faces the delicate task of rebuilding consumer trust while pursuing innovation. Their announced exploration into user-generated AI content presents both opportunities and risks in a market where public sentiment regarding artificial intelligence remains volatile. The company's landmark partnership with OpenAI raises intriguing questions about how Disney might integrate AI capabilities into their streaming platforms while navigating potential resistance from creative communities.

For Disney, achieving a balance between technological advancement and maintaining positive consumer relationships will be crucial in the coming year, suggesting a need for measured, thoughtful approaches to new initiatives.

Streaming platforms finally crossed into profitability in 2025,

yet defining success remains a complex puzzle for industry leaders.

'

The focus has shifted from subscriber growth at any cost

to sustainable financial health and cultural impact.

'

Major services are now scrutinizing engagement depth,

original content longevity, and global market penetration.

'

Even with improved balance sheets,

the metrics for true victory are still being debated.

'

International expansion offers new frontiers,

but replicating local hits demands nuanced strategy.

'

Film libraries and franchises hold potential as key differentiators,

though their streaming potency isn't always guaranteed.

'

Brand identity and consumer trust,

once damaged by rebranding missteps, require careful stewardship.

'

The path forward hinges on blending artistic prestige

with data-driven audience connection.

Streaming Entertainment Evolves: Analyzing 2025's Hits and Misses

The streaming landscape witnessed significant shifts in 2025, with notable successes and strategic pivots shaping the industry's future. Among the year's standout developments was the unprecedented triumph of an animated musical featuring K-pop demon hunters, which evolved into a cultural phenomenon under Sony's partnership with a major streaming platform. The film's impact extended beyond digital viewership—surpassing 500 million streams—to generate impressive theatrical revenue with its sing-along version collecting $19.2 million during its opening weekend.

While the entertainment giant celebrated this franchise win, its gaming division continued to struggle with identity. Despite leadership's candid acknowledgment of challenges, the company's gaming strategy underwent another notable pivot, abandoning expensive franchise adaptations in favor of casual, living room-friendly options. The subdued announcement of a Boggle adaptation at a Los Angeles industry conference underscored this scaled-back approach, creating a stark contrast with the company's otherwise exceptional performance across other divisions.

Looking ahead to 2026, the organization faces dual challenges: maintaining operational excellence while pursuing an ambitious $82.7 billion acquisition of Warner Bros.—a deal dwarfing any previous corporate purchase in its nearly 30-year history. Leadership's primary task will be preventing this massive corporate undertaking from distracting from core business operations.

The film division presents another intriguing storyline for 2026, as industry observers watch for the creative influence of recently appointed film chairman Dan Lin. Having joined mid-2024, the former Warner executive and producer of blockbuster franchises like The Lego Movie and IT may soon reshape the streaming giant's cinematic portfolio, potentially steering it away from recent offerings like Frankenstein, Electric State, and the latest Knives Out mystery.

Streaming Industry Transformation

In a pivotal shift for the streaming landscape, 2025 marked the year when major platforms finally achieved profitability, though industry leaders continue to grapple with defining success metrics beyond subscriber numbers.

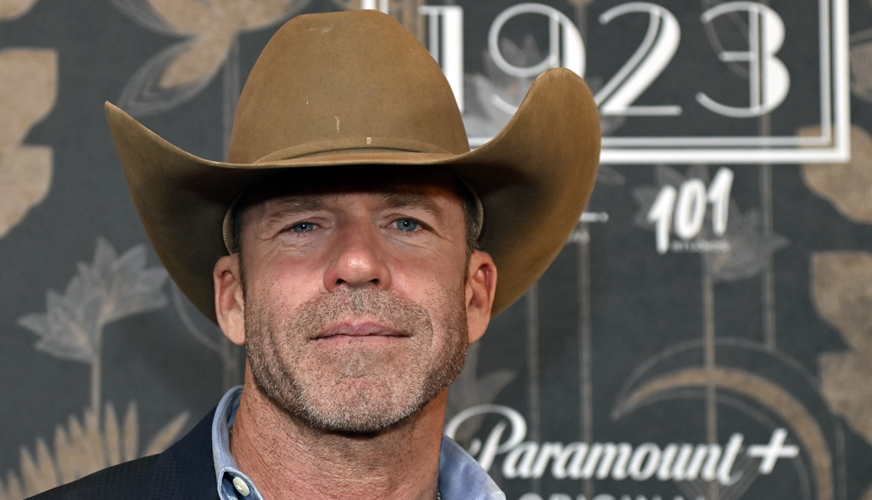

Content remained king throughout the year, with several studios leveraging their creative powerhouses. Paramount's relationship with Taylor Sheridan proved particularly fruitful, as his expanding universe of shows including "Landman," "Tulsa King," and "Mayor of Kingstown" delivered strong viewership. The company also found success with "Mobland," developed outside Sheridan's direct creative control but benefiting from his production team's involvement.

However, the streaming giant faced significant challenges amid corporate restructuring. The Skydance merger completion in August triggered widespread workforce reductions while simultaneously creating uncertainty about content strategy. Most notably, despite having years remaining on his contract, Sheridan announced his intention to join NBCU in 2029—a development that raised questions about newly appointed CEO David Ellison's ability to retain top creative talent.

Looking ahead to 2026, Paramount+ faces the critical task of diversifying its content portfolio beyond established franchises. While Sheridan's productions, "South Park," UFC programming, CBS content including NFL coverage, and theatrical releases provide reliable viewership, industry analysts suggest the platform needs breakthrough original programming to compete with top-tier streamers.

Technology integration represents another key focus area, with Ellison promising substantial platform improvements. The industry remains skeptical about whether these technological enhancements—potentially including AI implementations—will meaningfully differentiate the service or simply represent another instance of streaming platforms attempting to rebrand themselves as technology companies.

As consolidation continues across the media landscape, with Warner Bros. Discovery assets potentially in play, 2026 may determine whether Paramount+ can establish itself as an essential service rather than merely an interesting option in an increasingly competitive streaming environment.

The Streaming Landscape Shifts: Peacock's Journey Through 2025

In a year marked by significant streaming milestones, Peacock experienced both remarkable triumphs and concerning challenges throughout 2025. The platform's strategic focus on reality programming paid substantial dividends, while its approach to advertising raised eyebrows across the industry.

Reality TV emerged as Peacock's undeniable strength, with "Love Island USA" Season 7 shattering previous viewership records. The summer sensation accumulated an astounding 18 billion minutes viewed, claiming the title of Peacock's most-watched original season ever. The cultural phenomenon extended beyond the platform, with contestants achieving widespread recognition across social media and entertainment outlets.

On the scripted content front, Peacock secured moderate victories with "The Paper" and "All Her Fault," the latter making history by becoming the platform's first original series to top Luminate's weekly TV rankings since their inception. "The Office" spinoff demonstrated such promising potential that executives renewed it before its official release.

However, Peacock's aggressive advertising strategy became increasingly problematic. While ad-supported tiers have become standard across premium streaming services (with Apple being the notable exception), Peacock's implementation drew criticism. The introduction of "arrival ads" that confront users immediately upon login created a jarring user experience. Furthermore, NBCU's announcement of AI-powered technology designed to place advertisements around pivotal moments in live content—particularly sporting events—sparked viewer concerns about disruption during crucial viewing moments.

Looking ahead to 2026, Peacock faces existential questions about its essential value proposition. Following the cancellation of critically acclaimed shows like "Poker Face" and "Based on a True Story," the platform struggles to establish itself as indispensable in the scripted content arena.

Sports programming appears to be Peacock's potential salvation. The platform's upcoming sports portfolio includes MLB rights, Winter Olympics coverage, WNBA games, Premier League matches, NFL content, NBA programming, and a Super Bowl simulcast. This robust sports lineup may position Peacock as an essential service for sports enthusiasts, even as it continues seeking its identity in original entertainment programming.

The broader industry landscape presents additional complications, with potential mergers reshaping competitive dynamics. The impending sale of Warner Bros. to one of NBCU's competitors could further challenge Peacock's market position until Taylor Sheridan's anticipated arrival in 2029.

In 2025, streaming platforms celebrated notable milestones and faced significant challenges. A standout achievement was the remarkable resurgence of popular series like "The Summer I Turned Pretty" and "Thursday Night Football," which both demonstrated the power of engaging content. "The Summer I Turned Pretty" captivated audiences worldwide, attracting 70 million viewers across 70 days, marking a major success for Prime Video in the young adult genre. Meanwhile, NFL's "Thursday Night Football" experienced steady growth, with its fourth season surpassing last year's figures by 13%, marking three consecutive seasons of double-digit increases.

However, the year was also marked by a wave of cancellations that drew criticism. Amazon decided to pull the plug on numerous series, including "Étoile," "Butterfly," "Countdown," "Bosch: Legacy," "Motorheads," "The Wheel of Time," "Cruel Intentions," and "The Runarounds." While opinions differ on whether these cancellations were justified, there’s a growing consensus that frequent program cuts can damage viewer trust and overall consumer sentiment.

Looking ahead to 2026, Prime Video faces a somewhat sparse lineup. The return of "Fallout" and the delayed second season of "Mr & Mrs. Smith" are among the few flagship titles set for release. The end of "The Boys" with its fifth and final season, along with the uncertain prospects of "The Lord of the Rings: The Rings of Power," will shape the platform's future offerings. The latter's second season underperformed compared to its debut, casting doubt on future success. Despite these hurdles, new projects like the "Legally Blonde" prequel series "Elle" and "Blade Runner 2099," led by Michelle Yeoh, are expected to draw attention.

A central question for Amazon in 2026 revolves around its potential to become a comprehensive entertainment hub. Industry analysts speculate that Amazon may introduce a universal search feature, enabling users to seamlessly explore and access content across various streaming services. The platform has already begun pioneering this approach with a "news hub" aggregating content from hundreds of news outlets, hinting at its ambition to evolve into a one-stop shop—not only for shopping but for entertainment discovery as well.

What are the Harry Potter Movies about and Where to Watch

The Harry Potter film series chronicles the magical adventures of the titular young wizard and his friends as they confront the dark wizard Voldemort. If you're wondering where to watch harry potter, the movies are widely available for streaming on services like Max and Peacock, or for digital purchase on platforms such as Apple TV and Vudu.

Why Choose SafeShell as Your Netflix VPN?

If you want to access region-restricted content such as Harry Potter movies on Netflix, considering the SafeShell VPN can significantly enhance your streaming experience. One major advantage of the SafeShell VPN is its high-speed servers, which are specifically optimized for smooth and buffer-free Netflix streaming, allowing you to enjoy high-definition content without interruptions. Additionally, SafeShell VPN supports connection on multiple devices simultaneously, including popular operating systems like Windows, macOS, iOS, and Android, so you can watch your favorite shows across all your devices. Its exclusive App Mode feature further enables users to unlock and enjoy content from various regions at the same time, expanding your entertainment options. Moreover, SafeShell VPN ensures lightning-fast connection speeds without bandwidth restrictions, so you can stream, browse, and download effortlessly. With top-level security provided by its proprietary ShellGuard protocol, your online privacy remains protected, giving you peace of mind while streaming. Finally, the flexible free trial plan allows you to explore all these benefits risk-free, making SafeShell VPN an excellent choice for seamless and secure Netflix access.

A Step-by-Step Guide to Watch Harry Potter with SafeShell VPN

To watch Harry Potter with SafeShell VPN, start by subscribing to SafeShell VPN through their official website, selecting a plan that fits your needs and clicking the "Subscribe Now" button. Next, download and install the appropriate SafeShell VPN app or software version for your device, whether it's Windows, macOS, iOS, or Android. Once installed, launch the SafeShell VPN app and log in to your account. For an optimal streaming experience, select the APP mode within the app. Then, browse the list of available VPN servers and choose one located in the region where you want to access Harry Potter movies, such as the US, UK, or Canada. Click "Connect" to establish the VPN connection to your chosen server. Finally, open Netflix through the app or browser, log into your account, and enjoy watching Harry Potter movies from the region you selected, all securely and seamlessly with SafeShell VPN.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness