-

Fil d’actualités

- EXPLORER

-

Pages

-

Groupes

-

Blogs

-

Forums

Platform Acquisition Criteria for High-Growth SMBs

Platform acquisitions are the foundation of successful small and mid-sized business (SMB) investment strategies. Unlike add-on acquisitions, a platform acquisition serves as the core business upon which future growth, expansion, and bolt-on deals are built. For investors and operators alike, defining clear platform acquisition criteria is critical to achieving scalable, long-term value creation.

This article explores the key platform acquisition criteria used by experienced investors, including approaches aligned with a Top Performing SMB Investment Group, to identify businesses that can support sustainable growth and operational excellence.

What Is a Platform Acquisition?

A platform acquisition is the initial and most important investment in a buy-and-build strategy. It is typically a well-established SMB with strong leadership, stable cash flows, and infrastructure capable of supporting future acquisitions. The right platform allows investors to layer in add-on businesses efficiently, realizing synergies and accelerating value creation.

Because the platform sets the tone for the entire investment lifecycle, the selection process must be disciplined and data-driven.

Core Financial Criteria

Strong and predictable financial performance is a non-negotiable requirement. Investors typically look for:

-

Consistent EBITDA and revenue growth over multiple years

-

Healthy profit margins relative to industry benchmarks

-

Recurring or repeat revenue models that reduce volatility

-

Low customer concentration, minimizing dependency risk

A Top Performing SMB Investment Group prioritizes businesses with clean financial statements and transparent reporting, ensuring accurate valuation and smoother due diligence.

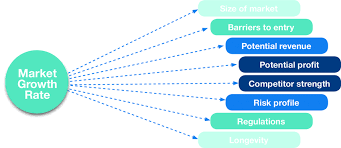

Market Position and Industry Attractiveness

The best platform companies operate in industries with favorable long-term fundamentals. Key market-related criteria include:

-

Fragmented industries that offer room for consolidation

-

Defensive or recession-resistant sectors

-

Strong demand drivers such as demographics, regulation, or technology adoption

-

Limited disruption risk from rapid innovation or commoditization

A strong competitive position—such as niche specialization or regional leadership—enhances the platform’s ability to absorb and integrate add-on acquisitions.

Management Team and Leadership Strength

Even the most attractive financials can fall short without capable leadership. Platform acquisition criteria heavily emphasize management quality, including:

-

Proven operational experience

-

Willingness to partner with investors

-

Alignment of incentives and long-term vision

-

Ability to scale systems and teams

Many investors seek owner-operators who are open to remaining involved post-acquisition, ensuring continuity while professionalizing operations.

Operational Scalability

A platform must be built to grow. Operational readiness is a defining factor and includes:

-

Documented processes and standard operating procedures

-

Scalable IT, accounting, and reporting systems

-

Ability to integrate new locations, teams, or services

-

Opportunities for cost optimization and efficiency gains

A Top Performing SMB Investment Group often evaluates how easily best practices can be replicated across future acquisitions, maximizing synergy potential.

Cultural Fit and Values Alignment

Culture is often underestimated but plays a major role in successful integration. Platform acquisition criteria should assess:

-

Employee retention and engagement levels

-

Customer-centric values

-

Ethical business practices and compliance

-

Openness to change and continuous improvement

A strong culture reduces friction during integrations and supports sustainable growth across the broader portfolio.

Growth Opportunities and Value Creation Levers

Beyond stability, the ideal platform offers clear upside. Investors look for identifiable levers such as:

-

Geographic expansion potential

-

Cross-selling or upselling opportunities

-

Pricing optimization

-

Professionalized sales and marketing strategies

Platforms with multiple growth avenues provide flexibility and resilience, even in changing market conditions.

Risk Management and Exit Readiness

Finally, a platform acquisition should support a clear exit strategy. Criteria often include:

-

Predictable cash flows attractive to future buyers

-

Strong governance and compliance structures

-

Auditable financials and KPIs

-

Clear equity story for strategic or financial exits

A disciplined approach, like that used by a Top Performing SMB Investment Group, ensures the business is built with the end in mind from day one.

Conclusion

Platform acquisition criteria are the backbone of successful SMB investment strategies. By focusing on financial strength, leadership quality, operational scalability, and growth potential, investors can build platforms that support long-term value creation. Whether you are an investor, operator, or advisor, applying these principles increases the likelihood of building a resilient, scalable SMB platform positioned for sustained success.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness