-

Noticias Feed

- EXPLORE

-

Páginas

-

Grupos

-

Blogs

-

Foros

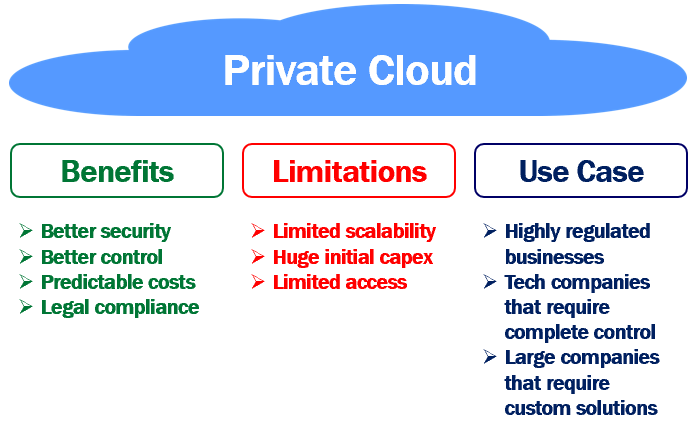

Understanding the Expanding US Private Cloud Services Market Size

The continuously expanding Private Cloud Services Market Size is a clear indicator of its integral role within contemporary enterprise IT infrastructure. This overall market size is a comprehensive metric, encompassing the total global spending on the hardware, software, and services required to build and operate private cloud environments. A significant factor contributing to this expansion is the broadening adoption beyond just large, Fortune 500 companies. Small and medium-sized enterprises (SMEs) are increasingly turning to private cloud solutions, particularly through hosted and managed service providers. These offerings allow SMEs to gain the security and performance benefits of a dedicated environment without the prohibitive upfront capital investment or the need for a large, specialized IT team, thereby democratizing access and significantly enlarging the total addressable market. The size of the Private Cloud Services Market is projected to grow at a CAGR of 9.00% over the forecast period from 2025 to 2035.

Another key driver enlarging the market size is the trend of workload modernization and repatriation. Many companies that initially adopted a "cloud-first" strategy, moving a majority of their applications to the public cloud, are now taking a more nuanced "cloud-smart" approach. They are discovering that certain stable, predictable, or data-intensive workloads can be run more cost-effectively and securely in a private cloud environment. This has led to a wave of "cloud repatriation," where companies are selectively moving applications back on-premises or to a hosted private cloud. Each of these repatriated workloads represents a new investment in private cloud resources, from additional server capacity to more advanced management software, which directly contributes to the growth of the overall market size.

The sheer volume and gravity of enterprise data are also fundamentally expanding the market. As businesses generate and collect more data from more sources—from IoT devices to customer interactions—the need for secure, high-performance storage and processing solutions intensifies. The concept of "data gravity," where it is easier to bring compute to the data rather than move massive datasets, makes private clouds an attractive option. Organizations are building large, private data lakes and AI/ML processing clusters to analyze this data without incurring the massive data egress fees associated with public clouds. This explosion in data-centric workloads is driving significant spending on high-capacity storage and powerful compute infrastructure, serving as a powerful engine for increasing the total market size.

Looking ahead, the proliferation of edge computing is set to become a major contributor to the market's expansion. Edge computing involves processing data closer to where it is generated to reduce latency and bandwidth usage. This is leading to the deployment of thousands of smaller, private cloud-like environments in locations such as factory floors, retail stores, and cell towers. Each of these edge locations requires its own set of servers, storage, and management software, effectively creating a distributed network of private clouds. This decentralization of IT represents a massive new frontier for the market, as vendors develop specialized solutions for deploying and managing these edge environments at scale, promising to swell the market size for years to come.

Explore Our Latest Trending Reports:

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness