Digestive Health Products Market Size Projected to Reach USD 108.11 Billion by 2032

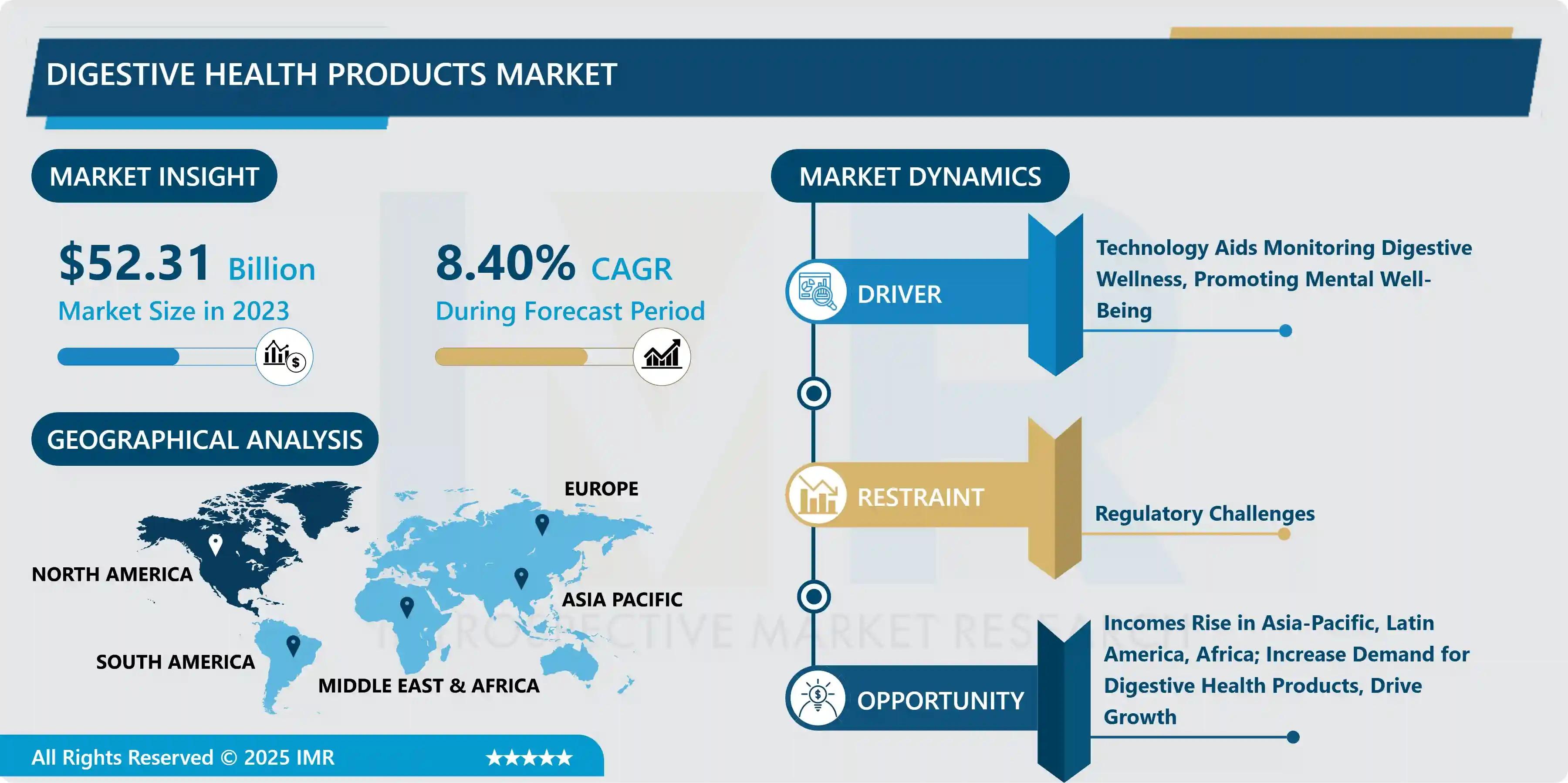

According to a new report published by Introspective Market Research, Digestive Health Products Market by Product Type, Distribution Channel, and Application, The Global Digestive Health Products Market Size Was Valued at USD 52.31 Billion in 2023 and is Projected to Reach USD 108.11 Billion by 2032, Growing at a CAGR of 8.4%.

Market Overview

The Digestive Health Products Market is experiencing strong growth driven by rising awareness of gut health, increasing prevalence of gastrointestinal disorders, and growing consumer preference for preventive healthcare solutions. Digestive health products include probiotics, prebiotics, digestive enzymes, fiber supplements, and functional foods designed to support gut microbiota balance and improve overall digestive function.

Growth Driver

A key growth driver of the Digestive Health Products Market is the increasing global awareness regarding the importance of gut microbiome health. Scientific research linking digestive health to immunity, mental well-being, and metabolic function has significantly influenced consumer behavior. Rising incidences of digestive disorders such as irritable bowel syndrome (IBS), acid reflux, and constipation are encouraging individuals to adopt preventive dietary supplements. Additionally, healthcare professionals increasingly recommend probiotics and fiber-based supplements, boosting product adoption across various age groups and supporting sustained market growth.

Market Opportunity

A major opportunity in the market lies in the expansion of functional foods and beverages enriched with digestive health ingredients. Consumers are increasingly preferring convenient formats such as fortified yogurts, kombucha, nutrition bars, and ready-to-drink probiotic beverages. The growing demand for personalized nutrition, combined with advancements in microbiome research, enables companies to develop targeted digestive health formulations. Emerging markets in Asia-Pacific and Latin America also present untapped growth potential due to rising disposable incomes and improving healthcare awareness, offering lucrative opportunities for market players.

The Digestive Health Products Market is segmented on the basis of Product Type, Distribution Channel, and Application.

Product Type

The Product Type segment is further classified into Probiotics, Prebiotics, and Digestive Enzymes. Among these, the Probiotics sub-segment accounted for the highest market share in 2023. Probiotics are live beneficial microorganisms that help maintain gut flora balance and improve digestive function. Their strong clinical backing, widespread consumer acceptance, and availability in multiple forms such as capsules, powders, and fortified foods have driven their dominance. Increasing demand for immunity-boosting products post-pandemic has further strengthened probiotic consumption, positioning this sub-segment as the leading revenue contributor in the market.

Distribution Channel

The Distribution Channel segment is further classified into Online Retail, Pharmacies & Drug Stores, and Supermarkets/Hypermarkets. Among these, the Pharmacies & Drug Stores sub-segment accounted for the highest market share in 2023. Consumers often prefer purchasing digestive health supplements from pharmacies due to professional guidance and trust in certified products. The presence of a wide range of clinically approved brands and increasing pharmacist recommendations have supported strong sales through this channel. Additionally, established distribution networks enhance product accessibility across urban and semi-urban regions.

Some of The Leading/Active Market Players Are-

- Nestlé Health Science (Switzerland)

• Danone S.A. (France)

• Yakult Honsha Co., Ltd. (Japan)

• Procter & Gamble Co. (USA)

• Amway Corporation (USA)

• Herbalife Nutrition Ltd. (USA)

• Bayer AG (Germany)

• GlaxoSmithKline plc (United Kingdom)

• Pfizer Inc. (USA)

• Chr. Hansen Holding A/S (Denmark)

• Kerry Group plc (Ireland)

• ADM (Archer Daniels Midland Company) (USA)

and other active players.

Key Industry Developments

News 1:

In March 2024, a leading global nutrition company expanded its probiotic supplement portfolio targeting immune and digestive health support.

The expansion included new strain-specific formulations backed by clinical research. This move reflects increasing demand for science-based digestive solutions and highlights the growing integration of microbiome research into product innovation strategies.

News 2:

In January 2024, a multinational food manufacturer launched a new range of gut-health-focused functional beverages across Asia-Pacific.

The product line includes fortified drinks containing prebiotics and plant-based fibers. This development underscores the growing consumer shift toward convenient, ready-to-consume digestive wellness products in emerging markets.

Key Findings of the Study

- Probiotics dominated the product type segment in 2023

• Pharmacies led the distribution channel segment

• Rising gut health awareness drives market growth

• Functional foods and personalized nutrition are key trends

• North America and Europe remain leading regions

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness